Taxes are applicable for all charter flights within the United States as well as international charter flights that enter or leave the United States. In some cases, flights in Mexico and Canada that are within 225 miles of the US Border are also subject to US taxes. Below, we break down the private jet charter taxes and explain how they are applied* in different flight scenarios.

*NOTE: The calculations and interpretations on this page should NOT be taken as an official interpretation of IRS rules and regulations. We are not responsible for any errors in the sample calculations below or misinterpretation of IRS regulations. The links to the official rules and regulations are provided in the Resources section for reference.

Table of Contents

- What are the different private jet charter taxes in the USA?

- What type of chartered flights are charged FET and segment fees?

- What is the 225-mile zone?

- What type of chartered flights are exempt from FET?

- Which charter flights are exempt from the Domestic Segment Fee?

- Examples of how to calculate taxes on various private jet charter flights

- Domestic private charter flight within the continental United States

- Domestic private charter flight with a stop at a rural airport

- Open jaw flight determined to be a domestic charter flight

- Domestic charter flight over international waters

- International charter flight

- Uninterrupted international charter flight with a tech stop

- Charter flights from the United States to US possessions and the Caribbean

- Charter flights from US possessions to international destinations

- Resources

Types of Private Jet Charter Taxes in the USA

There are four different taxes applicable to private jet charters in the United States:

- Federal Excise Tax (FET)

- Domestic Segment Fees

- International Head Tax

- Hawaii/Alaska Head Tax

The FET has remained at 7.5% for the transportation of passengers and 6.25% for the transportation of property for many years as FET is not adjusted for inflation. In turn, the segment fees and head taxes have increased over the years. Here is the progression of these fees over the last 7 years.

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|---|---|

| Domestic Segment Fee (USD) | 3.90 | 4.00 | 4.00 | 4.00 | 4.10 | 4.20 | 4.20 | 4.30 | 4.30 |

| International Head Tax (USD) | 16.70 | 17.20 | 17.50 | 17.70 | 18.00 | 18.30 | 18.60 | 18.90 | 19.10 |

| Hawaii/Alaska Head Tax (USD) | 8.40 | 8.60 | 8.70 | 8.90 | 9.00 | 9.20 | 9.30 | 9.50 | 9.60 |

What Type of Chartered Flights are Charged FET and Segment Fees?

Any air transportation of passengers or property within the United States or the 225-mile zone (explained further below) in Canada or Mexico is subject to a combination of FET and segment fees.

- For any flight leg that begins and ends in the United States or the 225-mile zone in Canada or Mexico, that segment is subject to both FET and domestic segment fees.

- For any international flight leg that begins or ends in the United States or the 225-mile zone in Canada or Mexico, that segment is subject to the international head tax.

- The Alaska/Hawaii head tax is a reduced international head tax that applies only to departures from Alaska/Hawaii for domestic segments.

FET is charged on any amount paid for air transportation. This includes all costs, including other taxes, flight time expenses such as repositioning time, landing fees, local taxes, crew expenses. Any expense incurred in the movement or operation of the aircraft is subject to FET. Services for passenger convenience such as catering costs and ground transportation are not subject to FET.

What is the 225-mile zone?

The 225-mile zone is the part of the territory of Canada and Mexico that is equal to or less than 225 miles from the nearest border of the continental United States. Locations such as Nassau, Bahamas, and the US Virgin Islands that are not in Canada or Mexico are not part of the 225-mile zone. For example, Vancouver, Calgary, Montreal, Ottawa, and Toronto in Canada and Monterrey, Tijuana, and Nogales in Mexico are within the 225-mile zone while Edmonton in Canada and Mexico City in Mexico are not. FET and segment fees apply on all air transportation of people on a flight that begins or ends in the 225-mile zone.

What Types of Charter Flights are Exempt from FET?

Small Aircraft Exemption

Transportation by non-turbojet aircraft having a “maximum certificated takeoff weight” of 6,000 pounds or less are exempt from FET, except when the aircraft is operated on an “established line.” The IRS defines the maximum certificated takeoff weight as the maximum weight contained in the type certificate or airworthiness certificate for the aircraft. An established line, as defined by the IRS, is when the aircraft operates with some degree of regularity between definite points.

Uninterrupted International Air Transportation

Flights beginning in the United States that make an interim stop before departing the United States for a destination outside the United States are not subject to FET. However, this applies only when the interval between arrival and departure for the interim stop is less than 12 hours and there is no change in the passengers on board at the tech stop.

Similarly, for flights arriving from outside the United States that have to make an interim stop for customs or refueling in the United States before continuing further to their final destination in the United States, FET is not applicable.

Flights over International Waters or International Land

Certain domestic flights such as those from the continental United States or the 225-mile zone to Alaska and Hawaii may involve flying over international waters or international land. In such cases, the part of the flight over international waters or international land is exempt from FET. International waters and international land are considered to begin when the flight crosses from the United States to Canada or Mexico, or 3 nautical miles, or 3.45 statute miles from the low tide point on the coastline.

Open jaw transportation

“Open jaw” transportation occurs when either:

- An international flight that departs from the United States or its 225-mile zone, and returns to the United States or the 225-mile zone to a location different from the original departure point within the United States or 225-mile zone. (for example, a flight A → B → C where A and C are domestic locations within the United States or 225-mile zone and B is an international location), or:

- Transportation from the point of departure to a specified destination and return from a point other than the specified destination to the original point of departure.

And, where the points of the open jaw are within the continental United States or the 225-mile zone, the distance between the points of the open jaw does not exceed the distance of the shorter segment traveled.

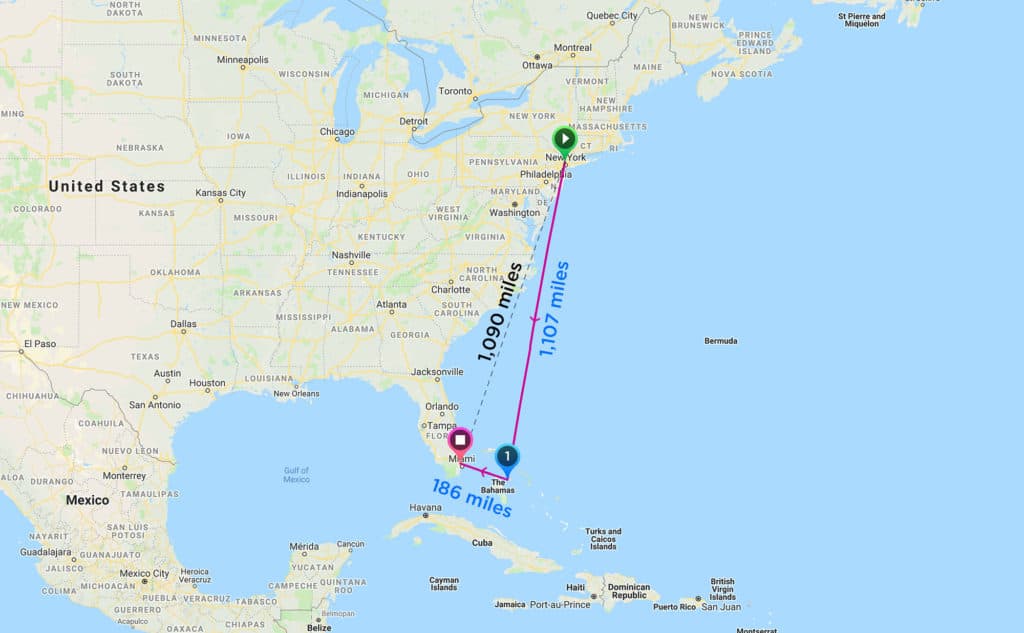

Let's explain it with the image below.

In the first scenario, for a trip from New York to Nassau and then from Nassau to Miami, the open jaw distance from New York to Miami is 1,090 miles, which is greater than the distance of the shorter leg, Nassau → Miami, of 186 miles. Therefore, this trip will be considered a domestic trip from New York to Miami and the FET of 7.5% will apply.

In the second scenario, for a trip from New York to Panama and then from Panama to New Orleans, the open jaw distance from New York to New Orleans is 1,178 miles, which is less than the distance of shorter leg, Panama → New Orleans, of 1,603 miles. Therefore, this trip will be considered as two international trips and FET will not be applicable. Only the international head tax will apply for each of the legs.

Other Exclusions and Exemptions

FET on air transportation does not apply to skydiving operations, sightseeing flights, forestry and logging flights, and landings on water. However, these exemptions usually apply to very specific factual situations.

Emergency Medical Services

FET does not apply to air transportation for emergency medical services:

- By helicopter.

- By a fixed-wing aircraft equipped for and exclusively dedicated on that flight to acute care emergency medical service.

Certain Uses

FET does not apply to the following operations:

- Helicopter transportation of individuals, equipment, or supplies in the exploration for, or the development or removal of, hard minerals, oil, or gas.

- Helicopter or fixed-wing aircraft transportation for the purposes of planting, cultivation, cutting, or transportation of, or caring for, trees (including logging operations).

The above exemptions only apply if the helicopter or fixed-wing aircraft do not take off from, or land at, a facility eligible for assistance under the Airport and Airway Development Act of 1970 or otherwise use Federal aviation services.

Which Charter Flights Are Exempt from the Domestic Segment Fee?

If a flight leg is to or from a rural airport, then the domestic segment fee does not apply. a rural airport is defined as an airport that has had less than 100,000 passengers departing on commercial flights during any calendar year and:

- Is not located within 75 miles of an airport that has 100,000 or more departing passengers or

- Is receiving essential air service subsidies as of August 5, 1997, or

- Is not connected by paved roads to another airport and had fewer than 100,000 commercial air passengers on flight segments of at least 100 miles during the second preceding calendar year.

A current list of rural airports can be found on the US DOT website here.

How to Calculate Taxes on Various Private Jet Charter Flights - Examples

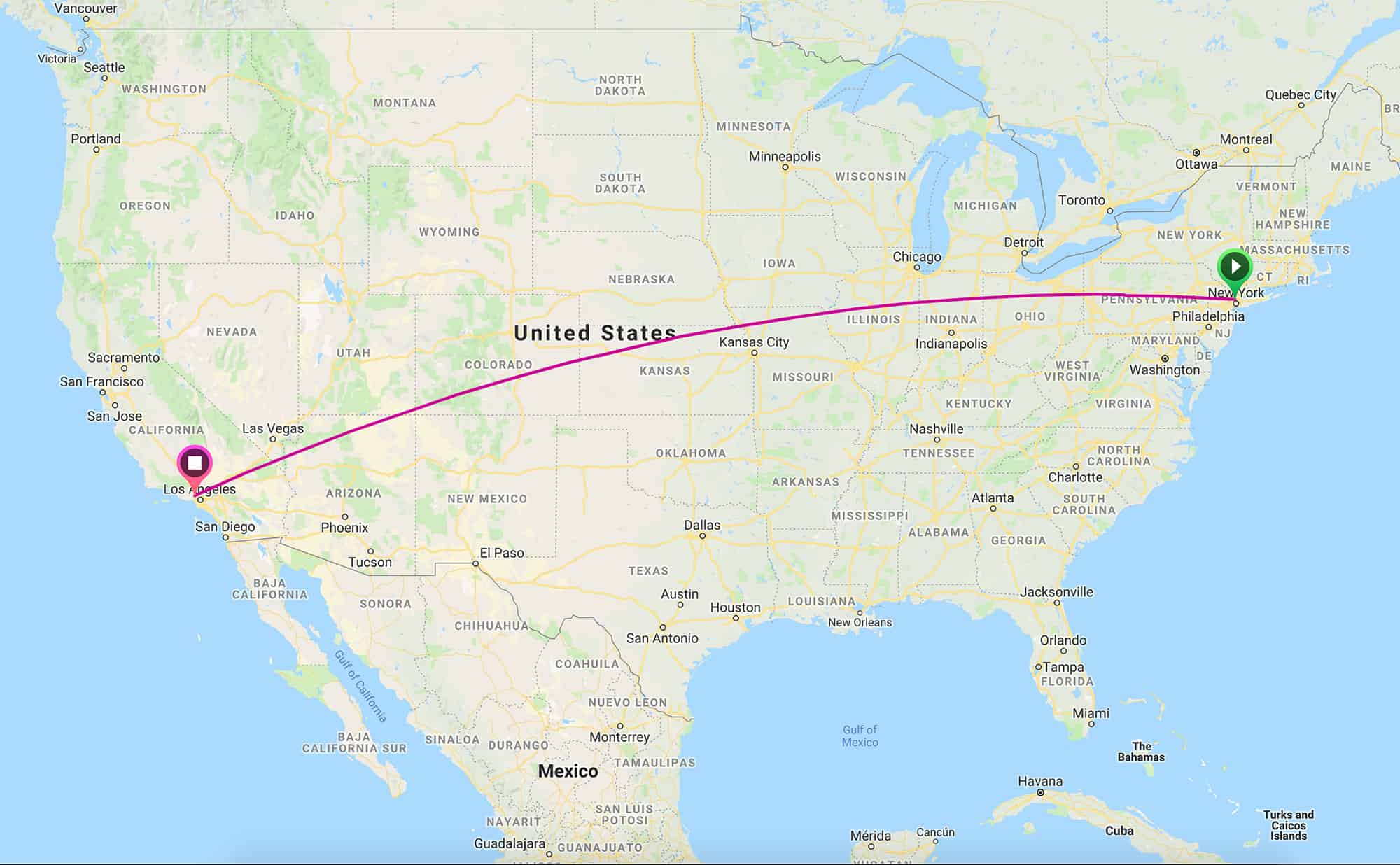

Domestic Private Charter Flight within the Continental United States

Itinerary: One-way from New York (TEB) to Los Angeles (VNY) for 4 pax on a Citation X+.

| Item | Amount (USD) |

|---|---|

| Charter Cost | 30,500.00 |

| FET (7.5%) | 2,287.50 |

| Domestic Segment Fees (4 pax × 1 leg × $5.00/pax/leg) | 20.00 |

| TOTAL | 32,807.50 |

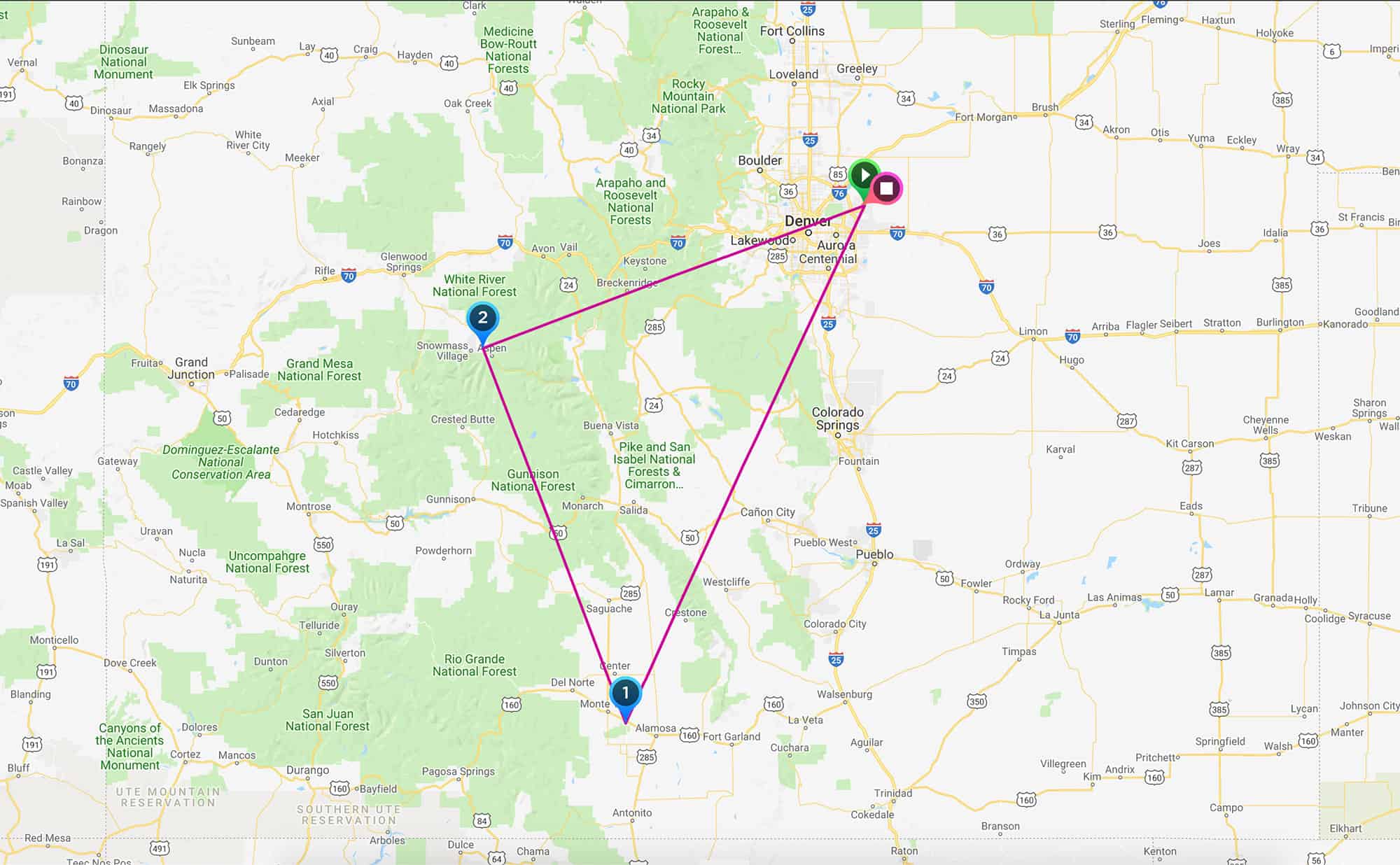

Domestic Private Charter Flight with a Stop at a Rural Airport

Itinerary: Multileg flight from Denver (DEN) to Monte Vista (MVI - rural airport) to Aspen (ASE) and back to Denver (DEN) for 5 pax.

Since Monte Vista (MVI) is a rural airport, the Denver → Monte Vista leg and the Monte Vista → Aspen leg are both exempt from domestic segment fees. The domestic segment fee will only apply to the Aspen → Denver leg.

| Item | Amount (USD) |

|---|---|

| Charter Cost | 15,500.00 |

| FET (7.5%) | 1,162.50 |

| Domestic Segment Fees (5 pax × 1 leg × $5.00/pax/leg) | 25.00 |

| TOTAL | 16,687.50 |

Open Jaw Flight Determined to be a Domestic Charter Flight

Itinerary: Multileg flight from New York (TEB) to Nassau (NAS) to Miami (OPF) for 6 pax.

Since this itinerary qualifies as an open jaw trip, and the open jaw distance from New York to Miami (1,090 miles) is more than the distance of the shorter leg from Nassau to Miami (186 miles), the flight is considered to be a domestic trip from New York → Miami and is subject to the FET of 7.5%.

| Item | Amount (USD) |

|---|---|

| Charter Cost | 18,000.00 |

| FET (7.5%) | 1,350.00 |

| Domestic Segment Fees (6 pax × 2 legs × $5.00/pax/leg) | 50.40 |

| TOTAL | 19,410.40 |

Domestic Charter Flight over International Waters

Itinerary: Round trip flight from Las Vegas (LAS) to Honolulu (HNL) for 6 pax.

For domestic flights that go over international waters or international land, the part flown over international waters or land is exempt from FET.

For a flight from Las Vegas to Honolulu, one-way distance is 2,763 miles. Since 2,433 miles is over international waters, only 330 miles are taxable. For a round trip, 660 miles out of a total 5,526 miles are taxable.

| Item | Amount (USD) |

|---|---|

| Charter Cost | 71,000.00 |

| FET (7.5%) = 0.075 × 71,000 = $5,325.00 FET/mile = $5,325.00 ÷ 5,526 miles = $0.9636/mile FET for 660 miles = $0.9636/mile × 660 miles = $635.98 | 635.98 |

| Domestic Segment Fees (6 pax × 2 leg × $4.20/pax/leg) | 50.40 |

| Hawaii/Alasksa Head Tax (6 pax × 1 leg × $9.30/pax/leg) (only applicable on departures from Hawaii) | 55.80 |

| TOTAL | 71,751.78 |

International Charter Flight

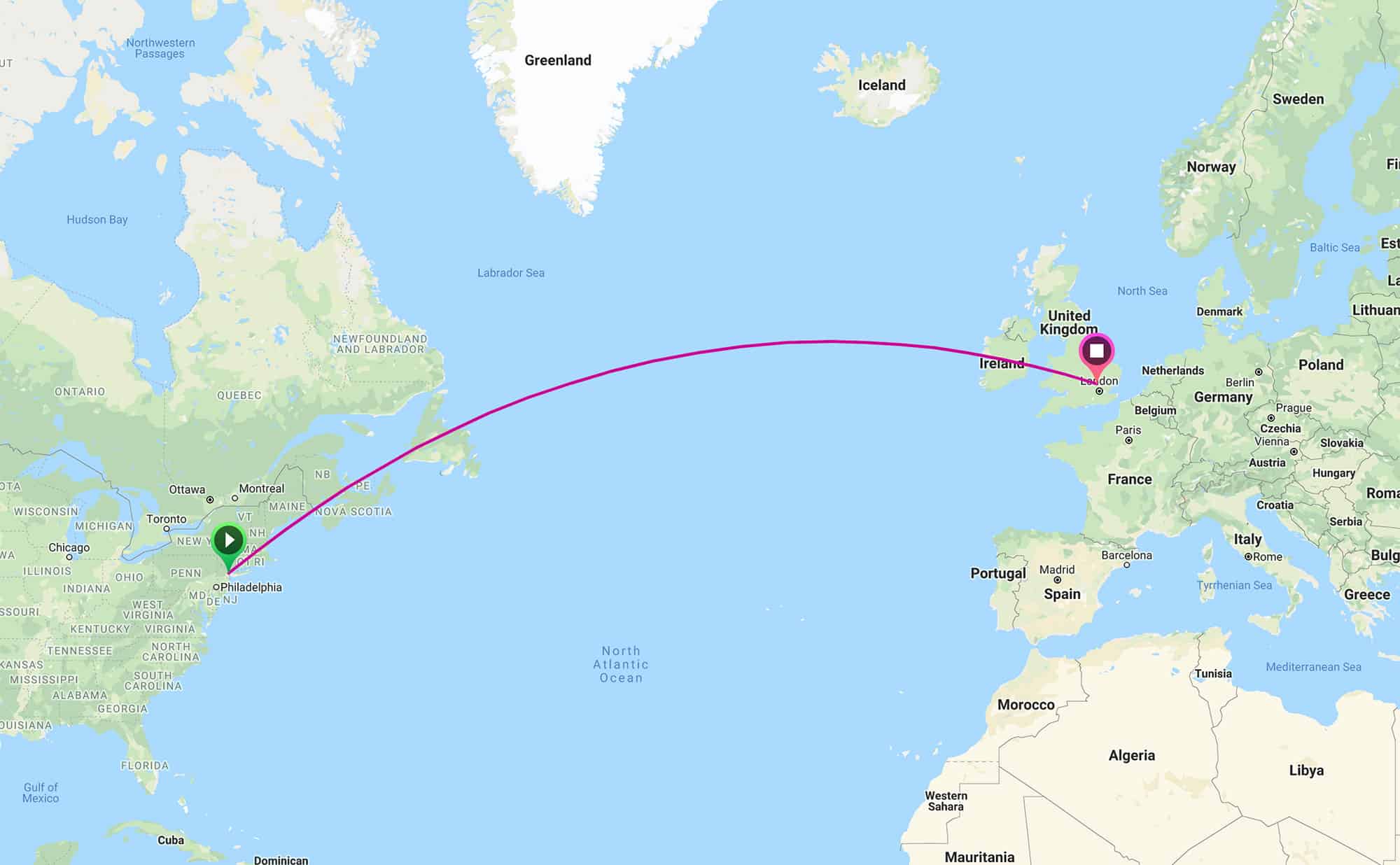

Itinerary: Round trip flight from New York (TEB) to London (EGGW) for 4 pax.

For international flights departing or arriving in the US, there is no FET applicable. However, there is an international head tax charged for each passenger for each leg.

| Item | Amount (USD) |

|---|---|

| Charter Cost | 145,000.00 |

| FET (7.5%) | 0.00 |

| International Head Tax (4 pax × 2 legs × $18.60/pax/leg) | 148.80 |

| TOTAL | 145,148.80 |

Uninterrupted International Charter Flight with a Tech Stop

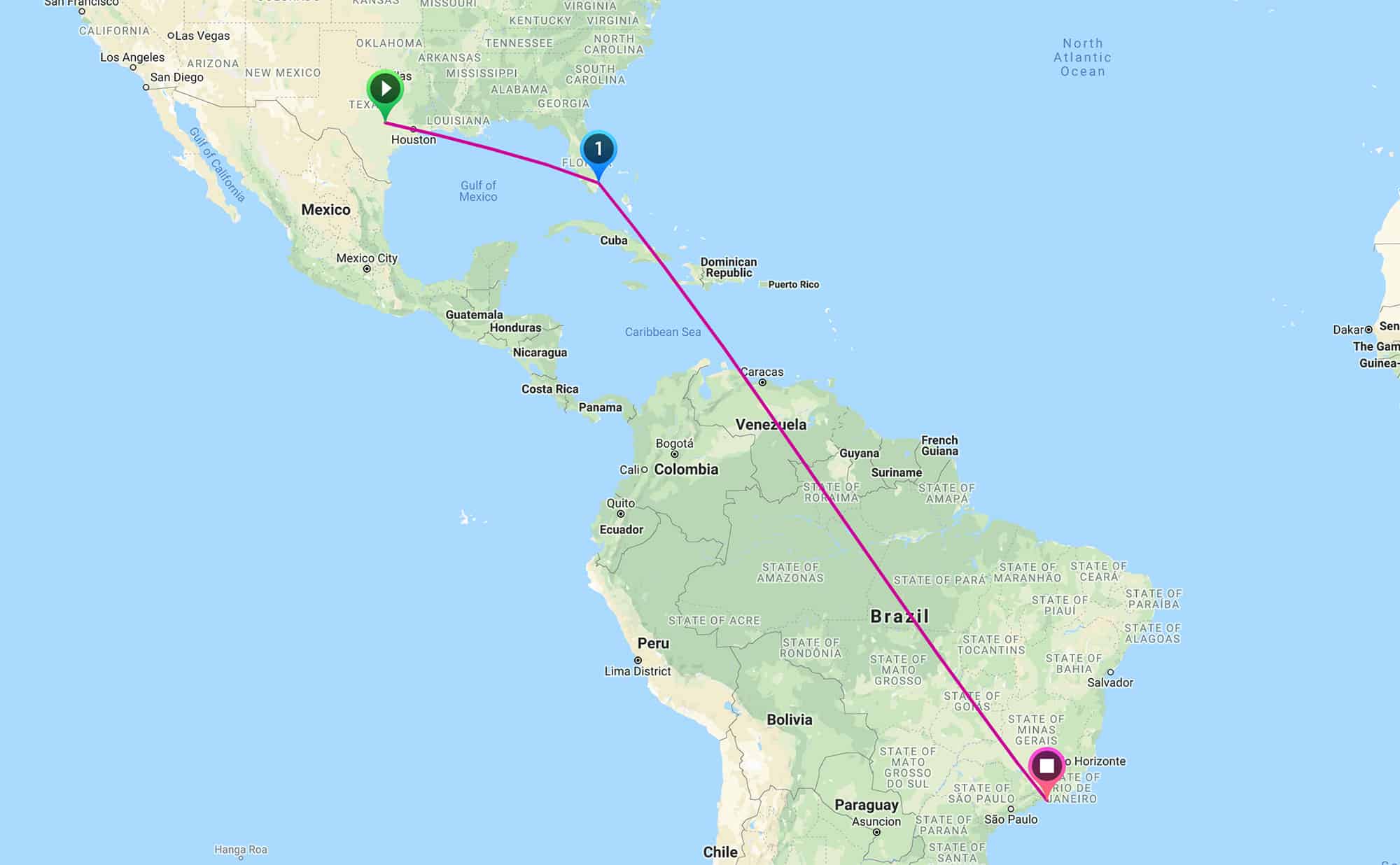

Itinerary: One-way uninterrupted international flight from Austin (AUS) to Rio de Janeiro (SNZ) for 8 pax with a tech stop in Miami (OPF).

Uninterrupted international air transportation happens when a flight departs the United States and makes a tech stop within the United States before continuing to an international destination. The reason for such tech stops is usually refueling but it can also be for customs purposes. A stop is considered a tech stop only if no passengers are dropped off or taken aboard at that point, and if the stop lasts less than 12 hours. The same rule applies when an international flight enters the United States and makes a tech stop before heading to its final destination within the United States. In such cases, no FET applies and only the international head tax is charged.

| Item | Amount (USD) |

|---|---|

| Charter Cost | 75,000.00 |

| FET (7.5%) | 0.00 |

| International Head Tax (8 pax × 1 leg × $18.60/pax/leg) | 148.80 |

| TOTAL | 75,148.80 |

If, for example, in the above scenario, one passenger was dropped off at Miami, then the stop would no longer be considered a tech stop. In this case, FET and domestic segment fees would be applicable for the Austin → Miami leg and only the international head tax for the Miami → Rio de Janeiro leg.

| Item | Amount (USD) |

|---|---|

| Charter Cost | 75,000.00 |

| FET (7.5%) = 0.075 × 75,000 = $5,625.00 FET/mile = $5,625.00 ÷ 5,257 miles = $1.07/mile FET for Austin → Miami leg (1,101 miles) = $1.07/mile × 1,101 miles = $1,178.07 | 1,178.07 |

| Domestic Segment Fees (8 pax × 1 leg × $5.00/pax/leg) | 40.00 |

| International Head Tax (7 pax × 1 leg × $18.60/pax/leg) | 130.20 |

| TOTAL | 76,348.27 |

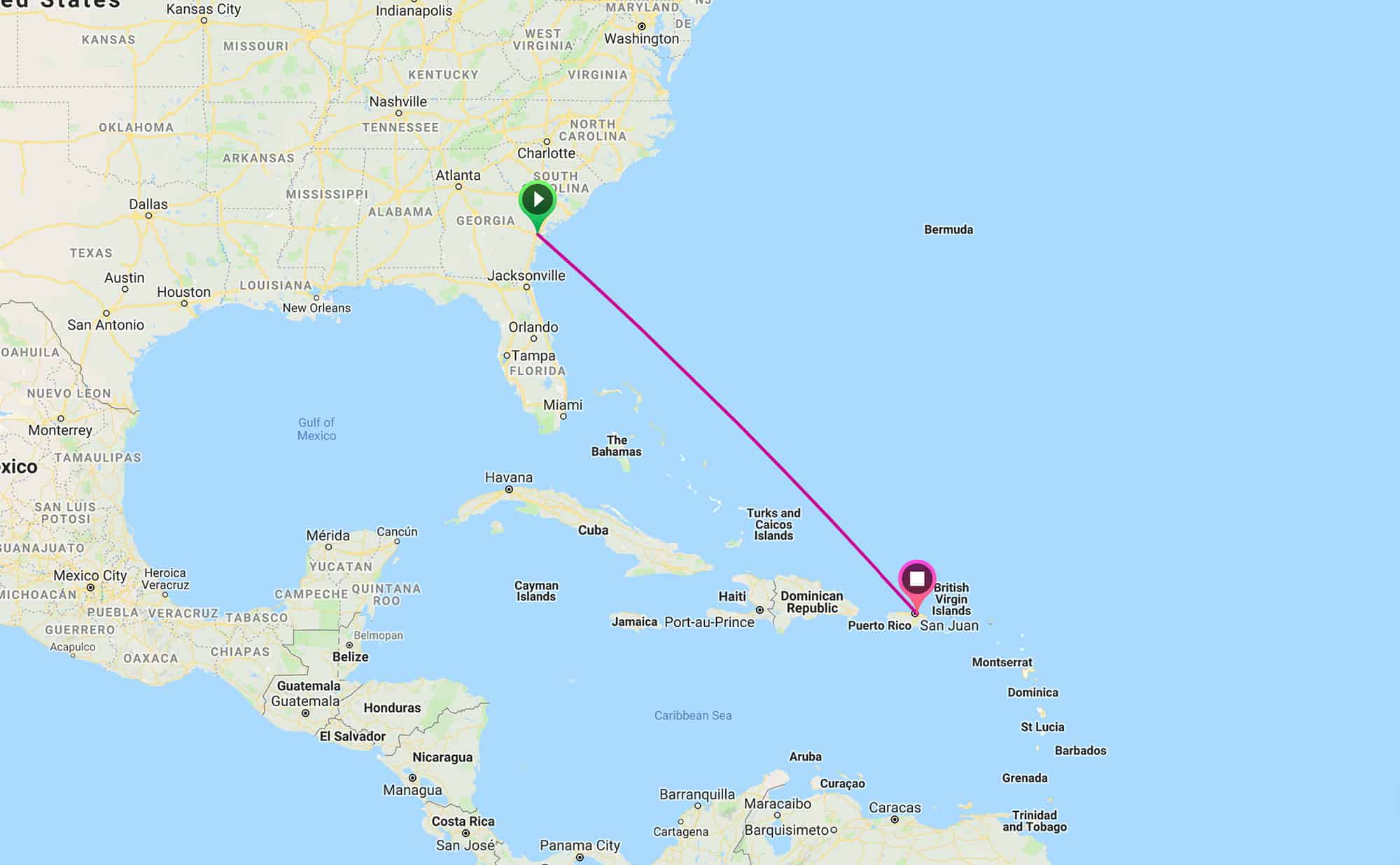

Charter Flights from the United States to the US Possessions and the Caribbean

Itinerary: One-way flight from Savannah (SAV) to San Juan, Puerto Rico (SJU) for 3 pax.

Flights from the United States to United States possessions such as Puerto Rico as well as flights from the United States to the Caribbean are considered to be international flights and are not subject to FET. Only the international head tax is charged. United States possessions and countries in the Caribbean are not subject to the 225-mile rule.

| Item | Amount (USD) |

|---|---|

| Charter Cost | 20,000.00 |

| FET (7.5%) | 0.00 |

| International Head Tax (3 pax × 1 leg × $18.60/pax/leg) | 55.80 |

| TOTAL | 20,055.80 |

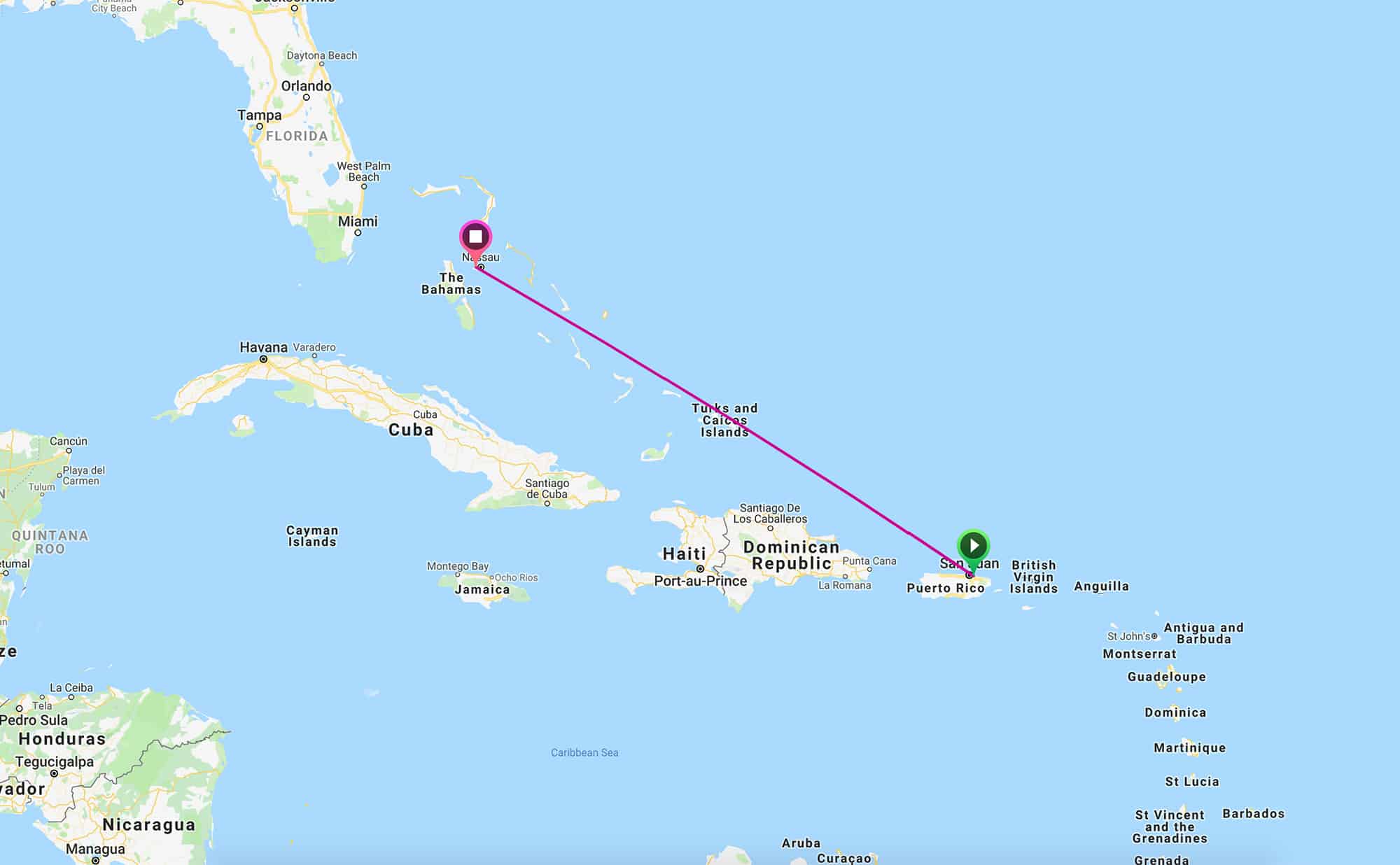

Charter Flights from the US Possessions to International Destinations

Itinerary: One-way flight from San Juan, Puerto Rico (SJU) to Nassau, Bahamas (NAS) for 2 pax.

Flights from the US Possessions to international destinations or vice-versa are not subject to any FET, segment fees, or international head taxes.

| Item | Amount (USD) |

|---|---|

| Charter Cost | 17,500.00 |

| FET (7.5%) | 0.00 |

| International Head Tax | 0.00 |

| TOTAL | 17,500.00 |

Note: FET and all segment fees are applicable to all payments made to a US entity for charter flights that meet the rules for taxation listed above.

Resources

- IRS Publication 510 - Excise Taxes

- IRS Audit Technique Guide – Air Transportation Excise Tax

- NBAA Federal Excise Taxes Guide